|

The labour party may be hinking about building more houses but behind the front there are various lobby organisations and firms which are seekign to seriously tax landowners.

Let's look at some of the ideas out there and why or whether they can or cannot work : a) The 'Labour Land Campaign' (labourland.org) is pushing for tax on ALL land and states : "All land should be valued and taxed according to its assessed value. As well as making it possible to reduce or abolish unfair, economically inefficient taxes, this will help repair the broken UK land market - characterised by speculation and underuse - that has deprived many citizens of secure, decent accommodation, for the benefit of a small-but-powerful, wealthy minority." Of course we have heard all this before from labour as it may be the politics of envy at work yet again. Most tax experts agree that the introduction of such a tax would probably create another banking crisis and land values might plummet and consequently cause huge mortgage affordability/funding issues. With around 30 million parcels of land in the UK could any system cope with a proper assessment of land value increases decreases be properly and fairly assessed ? It would no doubt result in a lot of Appeals about how much tax had been charged. b) Land Value Capture Tax - this is actually used in a number of countries already (e.g. the USA) and is in effect already in place in the UK through Section 106 ('s106') payments to Councils when planning permission is granted for new housing developments (as well as another tax call Community Infrastructure Levy ('CIL'). However, as with (a) above, if it was implemented in full it would probably cause huge problems within days due to risks to the financial markets. As highlighted by the 2019 report 'Land Value capture through planning and legislation' written and researched by Mark Stephens as part of a UK Housing Review, he noted that the Scottish Parliament found reasons for failure of such a scheme are that there are : "insufficient incentives for landowners to bring forward land for development; the lack of resourcing provided to agencies responsible for implementation (both administrative and, in the case of local authorities, to develop their own land banks); tensions between national agencies and local government, and the associated lack of sensitivity to local circumstances of a national scheme. Other factors were the relationship between a scheme and the economic/ property cycle, where a scheme developed during a property boom might be implemented during a downturn; and a perceived lack of fairness, exhibited for example when thresholds for development scale were set too low, so bringing in relatively trivial developments and sometimes causing hardship." Finally - Housebuilders - yes, it could be argued that housebuilders essentially 'tax' landowners by simply paying too little for their land by using Option Agreements with the dreaded 'We will issue a price notice' (i.e. THEY decide the price...) Tread carefully and perhaps consider getting a deal done soon before the Government tries to gobble a good chunk of your hard won profit and your family's rightful inheritance.

0 Comments

The potential for a new Labour government to come to power in late 2024 is set to potentially create big changes in the supply and development of land for new housing in the UK.

Various senior Labour politicians have stated they will significantly alter the Greenbelt rules for planning and that as many as 1,500,000 new homes are being targetted to be built within 5 years (considering that currently we build around 250,000 homes a year this would not actually be a significant rise). Great if it was an EXTRA 1.5 Million new homes - now that would make a difference ! However, without doubt the Nimby-driven, politically motivated, highly complicated and dreadfully slow planning system will probably get the overhaul it has needed for some time. This could mean that YOUR LAND may at last have a chance of gaining a planning permission and now is the time to engage with a development partner to start that process ? As interest rates drop and inflation falls, the land market (and economy) is looking much better for 2025-2026 and onwards and for some sites, getting a planning application in during 2024 or 2025 could mean you would be selling that site in a potentially very good market when the permission comes through. Selling at the right time in the land and housing market can make as much as a 50% difference in the price obtained, depending upon where in Britain the land is located. So do have another look at your field, farm or inherited land. Just saying 'Oh it'll happen one day' may no longer be the right decision. Landsite has been receiving a growing number of calls from concerned landowners who have found themselves signing into a promotion agreement with a land promoter and several years (sometimes months!) into the term of the agreement are now being approached to either change it or 'run' with a particular developer, suggested by the promoter.

This causes alarm for landowners as they will have been persuaded of the benefits of a promotion deal, only to find that a different or watered-down solution is now being offered. The reason(s) behind this appear twofold - firstly, the promoter has decided that they do not after all have the risk appetite or indeed in some cases the actual funds to obtain planning permission and progress the deal and would prefer to leave this to a well-heeled plc housebuilder and / or, secondly they have found the planning process is taking much much longer than they anticipated and perhaps they do not have the necessary experience or funds so they want to get back some of the money invested to date and take an easier route (potentially at the expense of the landowner !) Whilst Landsite has not witnessed this happening with the major land promoters (e.g. companies who are part of the LPDF (Land Promoters & Developers Federation), nevertheless, it appears to be a growing problem. Also, some land promoters have begun selling their business to plc housebuilders in recent years and it is difficult to properly establish whether these companies will now ask landowners to enter into an Option Agreement or even where the Promotion Agreement remains, whether there is genuine clarity about the site being properly and fully market-tested and thus sold to the highest bidder. If, in time, the highest bidder is consistently the housebuilder owner then questions may be asked. Plc housebuilders too seem to be 'stopping and starting' with a common complaint from the land managers and directors in the sector that the 'tap is being turned on and off' - recent announcements by Chief Executives of major housebuilders indicating they are holding back on buying land and closing sites has spooked a number of landowners who now wonder what the commitment is to their site. The fact that many of the land staff on the housebuilders move from company to company every few years does not help - something which is noticeably less the case with land promoters - perhaps the employee conditions or the people attracted to to work for land promoters are more motivated to stay there for longer. The attitude I have found at most Land Promoters is one where they are 100% honed to getting planning permissions delivered and of course all they do is land. Their structures are also very 'team' like and flat which helps for a good work ethic and they seem to employ more women - who are universally better at this business than the men as they have the right approach, insight and tenacity. Conversely, the plc housebuilders retain very corporate structures with a strong heirarchy and multiple matters such as sales rates, technical matters, build programmes and health and safety to distract them from...LAND. This of course means that the land element of their business is not top of the agenda and (in my opinion) landowners are certainly not at the top of their agenda ! With a probable Labour Government in place by early 2025 and 6 months later Lisa Nandy (Shadow Secretary for the Department for Levelling Up, Housing and Communities) may possibly seek to 'punish the tory shires' and take the lid off development restricted greenbelt and land around urban areas. Or perhaps not - if we are to believe that Sir Kier Starmer will embrace middle england as well as appealing to traditional Labour voters. For landowners, the very slow and complex planning system together with the awful parish, district, county and national politics are the main enemies to successful development of their land. Best to do deals with well-funded land promoters with a good track record and who can demonstrate they can and will deliver. The land market is changing - the top of the market was around mid-summer as we were all sweltering under a blazing sun when a site for 240 houses in Surrey received bids of over £50M - that equates to over £220,000 per plot (i.e. plot for a new house with planning permission to build it). Conversely, a site for 300 houses in Suffolk was seeing bids around the £20M mark.

Obviously Surrey (certain parts of it) are very exclusive and expensive but across the south-east and south of the country sim=nce Michael Gove ridiculously announced that the Government would not expect Councils to stick to the 'stalinist' housing targets which Liz Truss wanted to be rid of, the combined effect of the economic downturn, Ukraine and this new 'policy' has had a dramatic impact on the large plc housebuilders such as Taylor Wimpey, Barratt Homes, Bellway, Persimmon and others. There is now a real pull-back on land values and land acquisition. Think about it - if the papers are saying there will be a fall in house prices then potential buyers want to wait for house prices to fall. Others panic and put their hous eon the market and with too many sellers and too few buyers the price falls and then people lose their jobs because the economy is shrinking and the country has talked itself into a recession. So how does a landowner deal with this ? Well the first thing to bear in mind that recessions usually last perhaps 2 years at worst, maybe 3 and given the slow and difficult nature of obtaining planning permission it will take a developer or land promoter at least 2-3 years to obtain the planning permission they want. So actually doing a deal with a company now is not such a bad thing (2023) as by the time the site gets planning and you will be getting paid the 'recession' will almost certainly have passed. Most of the larger plc companies we deal with expect 2023 to be very tough but feel that the housing market will rebound in 2024. The alternative of course is for you to 'hold fire' and wait until the storm has passed - though personally I am a great fan of getting your horse in the race as soon as possible (with the right choice of jockey of course !). Land is land and will always have value. Putting your site out to the market via Landsite or any established land agent is something only YOU, as the landowner need decide. Do not be rushed into a quick decision and make sure that no only does the agent follow your wishes as much s possible but they are hard working and capable. The larger plc housebuilders were valuing 'plots' for houses in the south/south-east (e.g. a site with planning for 100 new houses has 100 'plots') at around £100,000 apiece in 2022 so at roughly 12 houses (plots) to the acre that gives you a good idea of the value of your site (but bear in mind to knock off say 10-15% as the 'gross' area of a site is less than the 'net' area actually developed for housing. In other parts of the UK land for housing development is probably closer to £50,000 per 'plot'. So - (say) £1,000,000 + an acre in the 'top' places and more like £500,000+ an acre in the areas which are not as 'hot'. An interesting article posted on the well-respected 'Construction Index' website recently highlighted the fact that the top positions of the plc housebuilders have been changing places in recent years as they deal with Coronavirus, increased costs and the ever-present challenge of developing more 'greenfield' sites to meet the demand for houses rather than flats - 'trapped in a flat with higher insurance costs, no garden and the fear of fire..' - well buy a new home on an estate in the countryside and enjoy garden, fresh air and space..'

The Construction Index analysis showed that 10 of the top twenty companies saw profits decline last year. With new blood (ex-Persimmon boss Jeff Fairburn invigorating housebuilder Avant Homes, the huge rise of the land promotion companies in the last 10 years and the changes which have already started in terms of how new homes are physically built (or should we say delivered on a truck nowadays) and it is clear that the industry is going through some interesting changes. Watch out for the regional family firms - the Davidsons Homes and Hill Homes, the growing capacity of the 'old' Housing Associations who are now full-stream private and social developers (the Keepmoat, Catalyst, Kier and Orbit of this world) together with the growth of companies like Legal & General Homes (L&G). It seems highly likely that if L&G make a great success of their homes business then more of the large financial institutions may follow and sooner or later some of the large US or Middle-East based capital houses will start injecting money into the sector if profits continue. Well, until a Labour Government brings in new taxes on land sales. https://www.theconstructionindex.co.uk/news/view/house-builders-start-to-struggle Industry sources which Landsite has recently been speaking to are saying that land with planning for residential development is being competitively priced as the Coronavirus 'lockdown' eases.

Two major plc housebuilder Land Directors have separately told Landsite that they have witnessed sites being sold for record prices in recent weeks and one Managing Director has confirmed that he has been informed by colleagues in charge of other Regional Offices that they think land prices are rising as competition for the best sites increases. Se this against the slow, slow world of planning and the restrictions of the greenbelt and it is no surprise that the housing land supply for a growing number of District and Borough Councils is falling below the important 5-year supply deadline/requirement. Land prices per acre which may be currently around £750,000 per acre (with planning) may therefore begin to edge towards the magic one million pounds per acre mark soon. For some latest news on prices see : www.housingtoday.co.uk/news/residential-land-value-grew-in-fourth-quarter-of-2020/5110122.article https://mspcapital.co.uk/land-development-prices-on-the-rise/ www.savills.com/research_articles/255800/310310-0 What does this mean for prospective landowners who have land with potential for residential development ? Well good news in that not only will land values keep rising for land with planning permission but the offers to enter into Option Agreements of Promotion Agreements with the Land Promoters, housebuilders and developers will be ever more generous and competitive in order to persuade landowners to run with their company rather than another. There are probably over 150 land promotion companies in the UK today varying in size from large, plc-backed firms employing perhaps 30+ specialist staff to smaller one-man businesses with some family or private funding behind them. The surface area of the United Kingdom which is is covered by almost 6% of built development (which includes airports, roads, retail, industrial and all other surfaced or developed areas. A further 3% is classed as gardens and urban parks (BBC survey data).

The Greenbelt in 2019 was estimated as being 1,621,150 hectares of land which is about 12.4% of the total area. TWICE as much land is classified as Greenbelt than existing developed land and yet most of that Greenbelt is located around our most prosperous and sought-after towns like London, Oxford and Cambridge. These are exactly the places where people wish to live and work. And the sad fact is that some of the Greenbelt land which could solve the housing crisis if it were to be developed is actually intensively farmed land or poor quality land. Another myth is if we cannot build on Greenbelt land then we should build new homes on brownfield sites. There are still plenty of brownfield sites in some of the old traditional industrial towns located in the Midlands or North of England and in less accessible areas of the country but again, this is not where the work is and not where people wish to live. The old garages, tyre centres, industrial fasteners, timber yards, dilapidated snooker halls, slaughterhouses and industrial premises which were once a feature of our towns and cities have now been re-developed for the wave of cheap Aldi, Lidl and discount stores, failing that then the specialist retirement market has hoovered up the remainder. There are NO brownfield sites left in the locations where demand for new housing is at its highest. After the economic recession of 2008-2020, the Grenfell Tower disaster and more recently Coronavirus potential house owners are seeking traditional houses with a garden and garage (if not to use for the car then for a 'home office') - this takes LAND and lots of it. There simply is not the available space, opportunity or availability of land for this type of development in many of the cities and larger towns so the new houses have to be built on the outskirts - often required exactly where the Greenbelt has been allocated. Of course there is a solution which surprisingly, a Labour Government tried to introduce and would have worked if they had properly incentivised the scheme. This was know as the 'Flat Conversion Allowance' and was introduced in the Finance Act in 2001 but take-up has been poor. If the property owners of retail buildings in (e.g.) anywhere from London, Birmingham, Cheltenham to Swansea were properly incentivised through council tax relief, serious government grants and even some attractive tax breaks, then this could witness a revolution in the number of new homes created in cities - safe (they are often only 2-3 storey so no high storey fire risk issues), larger (older buildings are usually more generous with room sizes) and excellently located for local services and green commutes to workplaces. A social benefit of this approach would be for new, vibrant communities to re-inhabit our city centres, invigorating the local shopping and community facilities and ensuring that their neighbourhoods were more connected and secure. An idyllic vision which will be unlikely to see fruition - and just for the record not all former Debenhams, BHS and John Lewis stores can be easily converted to apartments. Some can but most are just not in play for the planners and developers. The whole idea of 're-developing' city or town centres is sadly flawed unless there is a huge change in how homeowners wish to live and how Councils and Government resource, incentivise and fund such a change. The Greenbelt remains and will continue to remain the battleground for some time to come. 4 ways farmers can sell land for development - Farmers Weekly

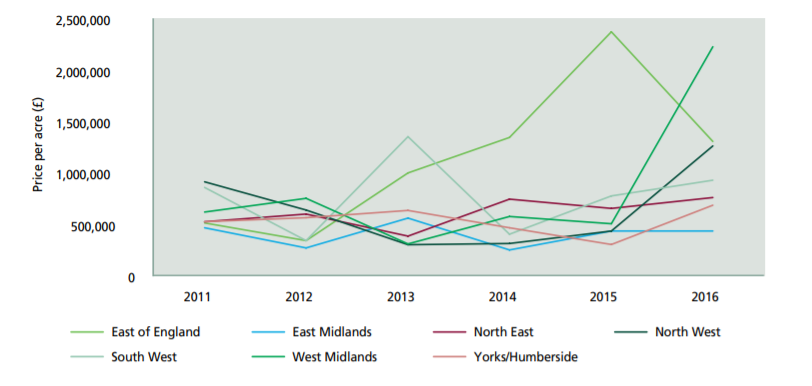

https://www.fwi.co.uk/business/markets-and-trends/land-markets/4-ways-farmers-can-sell-land-development The Alternatives For Selling or Developing Your Land https://www.linkedin.com/pulse/2021-alternatives-selling-your-land-landsite-land-consultancy/?trackingId=jZFAxTBFTFG49%2F%2F5B5ss0w%3D%3D Regenerative Farming More than just a buzzword - Farmers Weekly https://www.fwi.co.uk/news/opinion-regenerative-farming-is-more-than-just-a-buzzword [Graph above shows average transaction prices for development land between 2011 and 2015/16 and is courtesy of the Investment Property Forum]

It is vital for landowners to keep abreast of the price of their land and whether it's value is likely to rise or fall in the future. If you are thinking of selling your land or your are looking to deal with a land promoter or developer then having an early idea of the value of your land can be helpful. Below we round-up the latest available data for 2021 and provide an overview of what to expect for land with planning permission in the the next few years : Residential Development Land Prices The most reliable source of land prices is published by the UK Government using data from the Land Registry (see https://www.gov.uk/government/collections/land-value-estimates) and this shows values for EACH DISTRICT OR BOROUGH of the United Kongdom by : REGION / LOCAL AUTHORITY / £ PER HECTARE NOTE 1 : these are figures per hectare, not per acre - to achieve a value in acres divide the figure by 2.471 - e.g. Amber Valley £550,000 per hectare / 2.471 = £222,581 per acre. NOTE 2 : do bear in mind that these figures in some cases can be significantly higher than the reality and in some cases they will significantly lower - much depends upon the setting of your site and circumstances. As a real example, a site situated within Amber Valley which extends to 0.8 acres is being marketed (as at 03/03/2021) for £950,000 and has planning permission for 7 new build houses which has a gross sale value (usually known as the 'GDV') when built and sold of £3,100,000 (see https://www.onthemarket.com/details/9961602/). This figure is therefore almost three times what the government published data below indicates - but it is a relatively small site and smaller sites usually have higher values and that is what the 'asking price' is, not necessarily what the actual sale price might be. The majority of the information below can therefore be relied upon to some extent but we would personally advise discounting the sums below by as much as 25% to achieve a more realistic value. For up to date information on the value of your land please see our example sites below or contact us for a FREE VALUATION OF YOUR LAND at https://www.landsite.co.uk/. Prices below are a guide only and for ENGLAND only - if you want prices for Wales, Scotland, Northern Ireland or London then please call or email us at www.landsite.co.uk. East Midlands Land [price per hectare - £] Residential development land prices in Amber Valley £550,000 Residential development land prices in Ashfield £400,000 Residential development land prices in Bassetlaw £680,000 Residential development land prices in Blaby £2,150,000 Residential development land prices in Bolsover £370,000 Residential development land prices in Boston £500,000 Residential development land prices in Broxtowe £1,200,000 Residential development land prices in Charnwood £1,370,000 Residential development land prices in Chesterfield £970,000 Residential development land prices in Corby £620,000 Residential development land prices in Daventry £1,880,000 Residential development land prices in Derby £1,000,000 Residential development land prices in Derbyshire Dales £2,100,000 Residential development land prices in East Northamptonshire £1,100,000 Residential development land prices in Erewash £370,000 Residential development land prices in Gedling £550,000 Residential development land prices in Harborough £2,650,000 Residential development land prices in High Peak £1,100,000 Residential development land prices in Hinckley and Bosworth£1,530,000 Residential development land prices in Kettering £1,350,000 Residential development land prices in Leicester £1,460,000 Residential development land prices in Lincoln £1,200,000 Residential development land prices in Mansfield £1,100,000 Residential development land prices in Melton £950,000 Residential development land prices in Newark and Sherwood £1,130,000 Residential development land prices in North East Derbyshire £670,000 Residential development land prices in North West Leicestershire £1,230,000 Residential development land prices in Northampton £2,040,000 Residential development land prices in Nottingham £1,200,000 Residential development land prices in Oadby and Wigston £1,710,000 Residential development land prices in Rushcliffe £1,700,000 Residential development land prices in Rutland £2,000,000 Residential development land prices in South Derbyshire £1,000,000 Residential development land prices in South Holland £450,000 Residential development land prices in South Kesteven £920,000 Residential development land prices in South Northamptonshire £2,850,000 Residential development land prices in Wellingborough £1,700,000 West Midlands / West Land [price per hectare - £] Residential development land prices in Birmingham £1,700,000 Residential development land prices in Bromsgrove £2,850,000 Residential development land prices in Cannock Chase £1,140,000 Residential development land prices in Coventry £1,810,000 Residential development land prices in Dudley £1,900,000 Residential development land prices in East Staffordshire £1,800,000 Residential development land prices in Herefordshire, County of £2,300,000 Residential development land prices in Lichfield £2,650,000 Residential development land prices in Malvern Hills £1,800,000 Residential development land prices in Newcastle-under-Lyme £1,000,000 Residential development land prices in North Warwickshire £1,700,000 Residential development land prices in Nuneaton and Bedworth £1,370,000 Residential development land prices in Redditch £2,450,000 Residential development land prices in Rugby £2,250,000 Residential development land prices in Sandwell £1,770,000 Residential development land prices in Shropshire £1,500,000 Residential development land prices in Solihull £4,270,000 Residential development land prices in South Staffordshire £2,340,000 Residential development land prices in Stafford £1,600,000 Residential development land prices in Staffordshire Moorlands £780,000 Residential development land prices in Stoke-on-Trent £820,000 Residential development land prices in Stratford-on-Avon £4,130,000 Residential development land prices in Tamworth £2,100,000 Residential development land prices in Telford and Wrekin £1,230,000 Residential development land prices in Walsall £1,110,000 Residential development land prices in Warwick £3,850,000 Residential development land prices in Wolverhampton £1,165,000 Residential development land prices in Worcester £2,650,000 Residential development land prices in Wychavon £2,230,000 Residential development land prices in Wyre Forest £1,450,000 Eastern & Anglia Land [price per hectare - £] Residential development land prices in Babergh £2,330,000 Residential development land prices in Basildon £4,000,000 Residential development land prices in Braintree £3,785,000 Residential development land prices in Breckland £1,870,000 Residential development land prices in Brentwood £7,000,000 Residential development land prices in Broadland £2,120,000 Residential development land prices in Broxbourne £5,000,000 Residential development land prices in Cambridge £6,250,000 Residential development land prices in Castle Point £3,850,000 Residential development land prices in Central Bedfordshire £3,700,000 Residential development land prices in Chelmsford £5,160,000 Residential development land prices in Colchester £2,475,000 Residential development land prices in Dacorum £7,000,000 Residential development land prices in East Cambridgeshire £2,300,000 Residential development land prices in East Hertfordshire £7,550,000 Residential development land prices in East Lindsey £800,000 Residential development land prices in Epping Forest £7,600,000 Residential development land prices in Fenland £370,000 Residential development land prices in Great Yarmouth £1,100,000 Residential development land prices in Harlow £4,500,000 Residential development land prices in Hertsmere £7,100,000 Residential development land prices in Huntingdonshire £2,700,000 Residential development land prices in Ipswich £2,350,000 Residential development land prices in King's Lynn and West Norfolk £1,150,000 Residential development land prices in Luton £3,060,000 Residential development land prices in Maldon £3,790,000 Residential development land prices in Mid Suffolk £2,100,000 Residential development land prices in North Hertfordshire £6,100,000 Residential development land prices in North Kesteven £850,000 Residential development land prices in North Norfolk £2,460,000 Residential development land prices in Norwich £2,400,000 Residential development land prices in Peterborough £1,600,000 Residential development land prices in Rochford £4,300,000 Residential development land prices in Cambridgeshire £5,390,000 Residential development land prices in Norfolk £2,250,000 Residential development land prices in Southend-on-Sea £3,650,000 Residential development land prices in St Albans £8,900,000 Residential development land prices in St. Edmundsbury £3,300,000 Residential development land prices in Stevenage £4,200,000 Residential development land prices in East Suffolk £2,150,000 Residential development land prices in Tendring £1,750,000 Residential development land prices in Three Rivers £6,900,000 Residential development land prices in Thurrock £3,510,000 Residential development land prices in Uttlesford £4,580,000 Residential development land prices in Watford £6,800,000 Residential development land prices in Waveney (now merged with East Suffolk) £1,150,000 Residential development land prices in Welwyn Hatfield £6,050,000 Residential development land prices in West Lindsey £370,000 Yorkshire & Humber Land [price per hectare - £] Residential development land prices Barnsley £760,000 Residential development land prices Bradford £700,000 Residential development land prices Calderdale £1,140,000 Residential development land prices Craven £2,050,000 Residential development land prices Doncaster £750,000 Residential development land prices East Riding of Yorkshire £1,945,000 Residential development land prices Hambleton £2,150,000 Residential development land prices Harrogate £2,940,000 Residential development land prices Kingston upon Hull, City of £550,000 Residential development land prices Kirklees £1,500,000 Residential development land prices Leeds £2,150,000 Residential development land prices North East Lincolnshire £750,000 Residential development land prices North Lincolnshire £370,000 Residential development land prices Richmondshire £1,680,000 Residential development land prices Rotherham £900,000 Residential development land prices Ryedale £1,800,000 Residential development land prices Scarborough £1,570,000 Residential development land prices Selby £1,000,000 Residential development land prices Sheffield £870,000 Residential development land prices Wakefield £1,200,000 Residential development land prices York £2,750,000 North East Land [price per hectare - £] Residential development land prices Darlington £640,000 Residential development land prices County Durham £700,000 Residential development land prices Gateshead £720,000 Residential development land prices Hartlepool £615,000 Residential development land prices Middlesbrough £600,000 Residential development land prices Newcastle upon Tyne £850,000 Residential development land prices North Tyneside £1,150,000 Residential development land prices Northumberland £650,000 Residential development land prices Redcar and Cleveland £400,000 Residential development land prices South Tyneside £400,000 Residential development land prices Stockton-on-Tees £600,000 Residential development land prices Sunderland £600,000 North West Land [price per hectare - £] Residential development land prices Allerdale £370,000 Residential development land prices Barrow-in-Furness £1,100,000 Residential development land prices Blackburn with Darwen £450,000 Residential development land prices Bolton £1,110,000 Residential development land prices Burnley £370,000 Residential development land prices Bury £1,380,000 Residential development land prices Carlisle £370,000 Residential development land prices Cheshire East £1,300,000 Residential development land prices Cheshire West and Chester £2,760,000 Residential development land prices Chorley £1,245,000 Residential development land prices Copeland £370,000 Residential development land prices Eden £1,430,000 Residential development land prices Fylde £1,700,000 Residential development land prices Halton £1,830,000 Residential development land prices Hyndburn £1,100,000 Residential development land prices Knowsley £870,000 Residential development land prices Lancaster £1,650,000 Residential development land prices Liverpool £815,000 Residential development land prices Manchester £2,130,000 Residential development land prices Oldham £850,000 Residential development land prices Pendle £710,000 Residential development land prices Preston £1,175,000 Residential development land prices Ribble Valley £1,770,000 Residential development land prices Rochdale £900,000 Residential development land prices Rossendale £1,160,000 Residential development land prices Salford £1,500,000 Residential development land prices Sefton £1,450,481 Residential development land prices South Lakeland £1,750,000 Residential development land prices South Ribble £1,250,000 Residential development land prices St. Helens £1,120,000 Residential development land prices Stockport £2,400,000 Residential development land prices Tameside £1,950,000 Residential development land prices Trafford £2,240,000 Residential development land prices Warrington £1,400,000 Residential development land prices West Lancashire £1,390,000 Residential development land prices Wigan £900,000 Residential development land prices Wirral £1,170,000 Residential development land prices Wyre £1,500,000 South East Land [price per hectare - £] Residential development land prices Adur £4,100,000 Residential development land prices Arun £3,350,000 Residential development land prices Ashford £2,510,000 Residential development land prices Aylesbury Vale £3,450,000 Residential development land prices Basingstoke and Deane £2,900,000 Residential development land prices Bracknell Forest £5,100,000 Residential development land prices Brighton and Hove £7,160,000 Residential development land prices Canterbury £5,450,000 Residential development land prices Cherwell £4,100,000 Residential development land prices Chichester £4,800,000 Residential development land prices Chiltern £8,210,000 Residential development land prices Crawley £4,840,000 Residential development land prices Dartford £4,100,000 Residential development land prices Dover £2,350,000 Residential development land prices East Hampshire £6,000,000 Residential development land prices Eastbourne £3,750,000 Residential development land prices Eastleigh £3,800,000 Residential development land prices Elmbridge £9,280,000 Residential development land prices Epsom and Ewell £7,350,000 Residential development land prices Fareham £3,725,000 Residential development land prices Gosport £1,820,000 Residential development land prices Gravesham £3,850,000 Residential development land prices Guildford £7,625,000 Residential development land prices Hart £5,730,000 Residential development land prices Hastings £2,360,000 Residential development land prices Havant £3,910,000 Residential development land prices Horsham £5,330,000 Residential development land prices Isle of Wight £1,600,000 Residential development land prices Lewes £4,450,000 Residential development land prices Maidstone £2,800,000 Residential development land prices Medway £3,370,000 Residential development land prices Mid Sussex £5,150,000 Residential development land prices Milton Keynes £3,050,000 Residential development land prices Mole Valley £7,200,000 Residential development land prices New Forest £5,750,000 Residential development land prices Oxford £5,090,000 Residential development land prices Portsmouth £3,000,000 Residential development land prices Reading £4,800,000 Residential development land prices Reigate and Banstead £6,500,000 Residential development land prices Rother £2,950,000 Residential development land prices Runnymede £7,780,000 Residential development land prices Rushmoor £4,300,000 Residential development land prices Folkestone and Hythe £2,270,000 Residential development land prices Sevenoaks £8,300,000 Residential development land prices Slough £5,450,000 Residential development land prices South Bucks £6,150,000 Residential development land prices South Oxfordshire £5,630,000 Residential development land prices Southampton £2,700,000 Residential development land prices Spelthorne £6,000,000 Residential development land prices Surrey Heath £5,800,000 Residential development land prices Swale £3,280,000 Residential development land prices Tandridge £6,100,000 Residential development land prices Test Valley £2,550,000 Residential development land prices Thanet £2,850,000 Residential development land prices Tonbridge and Malling £4,250,000 Residential development land prices Tunbridge Wells £4,700,000 Residential development land prices Vale of White Horse £3,930,000 Residential development land prices Waverley £6,200,000 Residential development land prices Wealden £4,380,000 Residential development land prices West Berkshire £4,250,000 Residential development land prices West Oxfordshire £3,070,000 Residential development land prices Winchester £6,070,000 Residential development land prices Windsor and Maidenhead £7,050,000 Residential development land prices Woking £6,850,000 Residential development land prices Wokingham £5,370,000 Residential development land prices Worthing £4,500,000 Residential development land prices Wycombe £5,540,000 South West Land [price per hectare - £] Residential development land prices Bath & North East Somerset - £3,000,000 Residential development land prices Bournemouth £3,400,000 Residential development land prices City of Bristol of £3,250,000 Residential development land prices Cheltenham £3,380,000 Residential development land prices Christchurch £4,500,000 Residential development land prices Cornwall £1,995,000 Residential development land prices Cotswold £3,750,000 Residential development land prices East Devon £2,510,000 Residential development land prices East Dorset £3,450,000 Residential development land prices Exeter £2,900,000 Residential development land prices Forest of Dean £850,000 Residential development land prices Gloucester £2,300,000 Residential development land prices Isles of Scilly £3,480,000 Residential development land prices Mendip £1,650,000 Residential development land prices Mid Devon £2,050,000 Residential development land prices North Devon £1,770,000 Residential development land prices North Dorset £2,200,000 Residential development land prices North Somerset £2,310,000 Residential development land prices Plymouth £1,600,000 Residential development land prices Poole £3,400,000 Residential development land prices Purbeck £3,820,000 Residential development land prices Sedgemoor £1,600,000 Residential development land prices South Gloucestershire £2,900,000 Residential development land prices South Hams £2,170,000 Residential development land prices South Somerset £1,800,000 Residential development land prices Stroud £2,350,000 Residential development land prices Swindon £2,000,000 Residential development land prices Taunton Deane £1,800,000 Residential development land prices Teignbridge £2,000,000 Residential development land prices Tewkesbury £2,130,000 Residential development land prices Torbay £1,500,000 Residential development land prices Torridge £1,490,000 Residential development land prices West Devon £3,100,000 Residential development land prices West Dorset £2,900,000 Residential development land prices West Somerset £2,350,000 Residential development land prices Weymouth and Portland £2,200,000 Residential development land prices Wiltshire £1,920,000 Some further examples of sold prices (between 2020 to 2023) for land (calculated on gross land area) in the UK. See how much less the prices for doing an 'Option' deal are compared with a 'Land Promotion' deal : SUFFOLK EXAMPLE : 10 acres land sold with planning for 120 new houses for £3.8M which equates to £380,000 per acre (Housebuilder Option Deal). Compare with deal for 35 acres and 300 new houses for £20M which equates to £577,000 per acre (Land Promoter Deal). ESSEX : 13 acres of land sold with planning for 100 new houses for £8.5M which equates to £653,846 per acre. (Housebuilder Option Deal). Compare with 12 acres accommodating 140 new houses sold for £1,571,000 per acre (Land Promoter Deal). MIDLANDS : 14 acres of land with planning for 120 new houses for £7.0M which equates to £500,000 per acre. (Housebuilder Option Deal). Compare with site for 240 houses across 34 acre site sold for £24M which equates to £705,882 per acre (Land Promoter Deal). NORTH : 11 acres of land with planning for 95 new houses for £5.8M which equates to £527,272 per acre. (Housebuilder Option Deal). Compare with a site sold for 1200 houses across 170 acres sold for £112M which equates to £658,823 per acre (Land Promoter Deal). Please bear in mind that these land deals vary in site size so are not necessarily directly comparable but principle is there - i.e. tread very carefull indeed with any deal directly offered by a large housebuilder as ALL the evidence and ALL the data shows that the landowner will regularly get a much better land value (and faster planning permission) with a land promoter. Commercial Development / Offices - Land Sold - Prices Per Hectare [to achieve price per acre divide these figures by 2.471} Dudley £865,000 Aylesbury £865,000 Warrington £865,000 Chester £865,000 Croydon £43,890,000 Brighton and Hove £2,210,000 St Austell £865,000 Coventry £1,000,000 Nuneaton £865,000 Carlisle £865,000 Sheffield £1,200,000 Nottingham £1,240,000 Bournemouth £1,010,000 Poole £865,000 Kingston upon Thames £5,400,000 Basingstoke £1,740,000 Gloucester £865,000 Cheltenham £1,095,000 Birmingham Central £13,770,000 Solihull £865,000 Peterborough £865,000 Cambridge £24,360,000 Lincoln £865,000 Grimsby £865,000 Manchester Central £12,960,000 Bolton £865,000 Plymouth£865,000 Exeter £2,500,000 Watford £5,245,000 Hemel Hempstead £1,575,000 Kingston upon Hull £865,000 Blackpool £865,000 Blackburn £865,000 Leeds City £11,120,000 Bradford £865,000 Leicester £865,000 Liverpool City / Region £865,000 Birkenhead £865,000 London Victoria / London Central £480,680,000 Southwark £282,000,000 Harrow £6,270,000 Bromley £2,470,000 Norwich £865,000 Ipswich £865,000 Newcastle upon Tyne £1,380,000 Sunderland £865,000 Oxford £4,830,000 Doncaster £865,000 Rotherham £865,000 Southampton £1,010,000 Portsmouth £865,000 Redbridge £2,470,000 Bexley £2,470,000 Northampton £865,000 Luton £1,250,000 Stoke-on-Trent £865,000 Wolverhampton £865,000 Swindon £865,000 Tees Valley / Middlesbrough £865,000 Darlington £865,000 Thames Valley Berkshire Reading £26,200,000 Slough £15,580,000 Telford £865,000 Bristol City £14,030,000 Bath City £3,700,000 Worcester £865,000 Scarborough £865,000 Residential land prices will be almost certainly set to increase between 2021 and 2023 as the UK economy grows and continued demand for homes (especially houses rather than apartments). [UPDATE 2024 : RESIDENTIAL LAND PRICES FELL BY AS MUCH AS 50% IN SOME CASES AFTER THE 'TRUSS/ / KWARTENG' BUDGET AND INTEREST RATE RISE. tHEY WILL BE LIKELY TO RETURN TO 2020 LEVELS IN 2025 AND PUSH UP FROM THERE - TIMING OF A SALE OF YOUR LAND IS THEREFORE IMPORTANT] The increasing demand coupled with a continued lack of supply due to restrictive local authority planning rules and greenbelt designation combined with the fact that many brownfield sites have already been developed will mean that the sites that do become available will be fiercely bid by the plc housebuilders. The recent Budget announcement for tax breaks on investments activity within the UK together with huge new demand for logistics and warehousing will also lead to localised pressure for new housing to accommodate new employees locally - and thus sustainably. Commercial and industrial uses of land may well compete with the residential values in the near future as this sector expands rapidly. IF YOU INTEND TO 'LEAVE A REPLY' BELOW REGARDING AN ENQUIRY COULD I REQUEST THAT IF YOU REQUIRE CONTACTING THEN PLEASE EMAIL : [email protected] [NOTE THAT REPLIES SUBMITTED VIA THIS THIS BLOG ARE NOT MONITORED]. The rise of the land promoter has been a good thing for farmers and landowners across the UK but whilst this holds true for the largest, most well-established and funded promoters, what about the raft of smaller companies that have sprung up ?

The danger here lies in the actual agreement itself as should the land promoter fail then it is worth bearing in mind the landowner may well have signed-up to perhaps a 5 or 10 year (or the ever popular '5y+5yr+5yr' land promotion agreement) period and as such if the land promoter goes into bankruptcy then what are the legal implications for whether the deal can be transferred ? The Option Agreement does not have this problem and is of course usually taken out with a large, well funded plc housebuilder. But with the potential ahead for economic problems in the UK, should unemployment rise significantly and / interest rates climb then house sales will suffer and the housebuilders will reduce their need for buying land from land promoters - can smaller land promoters really carry the cost of perhaps several large planning applications with no realistic end sale result in sight ? |

About this Blog :Some useful articles & links to resources which landowners can read and connect with to assist them with learning more about the process, pitfalls, challenges and positive outcomes for selling their land. Archives

April 2024

Categories |

Landsite Limited

Registered office : Penrose House, 67 Hightown Road, Banbury, Oxfordshire OX16 9BE

Telephone : 01527 328401 Mobile : 07971 389985

E-Mail : [email protected] Web. www.landsite.co.uk

Please Note / Important : The views and opinions expressed on this website are the personal opinion of the author and do not represent the policies, views or opinions of the company. ALL information provided is for general guidance only and any actions or decisions the reader or user may take based upon content, information or opinion(s) expressed in this website is entirely at their own risk and liability. The information contained in this website cannot be legally relied upon at a later date and it is provided on a 'without prejudice' basis. Landsite Limited has no affiliation with any other company, website or organisation and it accepts no legal liabilities arising from use, misuse or mis-interptretation of the data and information contained within this website.

Proudly powered by Weebly

RSS Feed

RSS Feed